These companies are also infamous for order circulate preparations compensating brokerages that direct buyer orders to them. During unstable intervals, market makers assist stabilize costs by maintaining steady trading operations. They implement circuit breakers, modify spreads dynamically, and use statistical models to handle risk whereas ensuring market liquidity. Market making stands as a cornerstone of contemporary financial markets providing essential liquidity and stability. As technology evolves you’ll see market makers adapt with refined instruments and techniques to take care of crypto market makers efficient markets whereas managing dangers effectively.

- They profit from the bid-ask unfold, enabling efficient trading for traders.

- It may see extra sellers than consumers, pushing its stock larger and its costs down, or vice versa.

- These methods collectively help market makers fulfill their position and contribute to the graceful functioning of economic markets.

- Market makers play an important function in monetary markets, guaranteeing easy transactions, setting aggressive prices, and contributing to overall market stability.

- This implies that there exists a possibility for a market maker to purchase the Apple shares for $50 and sell them for $50.10.

This is as a result of, as market makers, these firms act as each counterparty and liquidity providers for their clients’ trades. This means that when purchasers make profitable trades, the CFD firm might lose money if they also maintain a position in the same instrument. One Other income for market makers comes from trading on their own behalf. Market makers have entry to real-time info and can use their information and expertise to make profitable trades in the markets.

Statistical Arbitrage

They stand able to both purchase and sell a selected monetary instrument, thereby facilitating the trading course of. Market makers participate in a broad selection of markets, together with stocks, commodities, international trade, and the ever-evolving realm of cryptocurrencies. With Out them, buying and selling would be less efficient, and markets could be more susceptible to wild price swings. Market makers with larger market share and volume traded are sometimes preferred by merchants and investors because of their ability to supply liquidity and facilitate environment friendly worth discovery. These metrics replicate the market maker’s affect and impression on the overall market dynamics. Furthermore, algorithms enable https://www.xcritical.com/ market makers to interact in statistical arbitrage.

Designated market makers (DMMs) on exchanges and corporations registered with FINRA are subject to strict regulatory oversight. These laws impose each affirmative and adverse obligations that govern their actions. Registration typically entails submitting detailed details about operations and compliance procedures to the SEC. This fixed presence effectively bridges the gap between consumers and sellers who might not otherwise discover each other shortly. This facilitates steady price discovery and clean market operations. This self-discipline is key to their success, as it permits them to navigate market fluctuations with a degree of predictability.

Inventory Market Leaders

It’s essential to acknowledge that while market makers are adept at looking for profit, their threat management strategies are equally subtle. The stability between revenue generation and risk mitigation is the fulcrum upon which market makers operate. This will ensures they’ll proceed to play their essential role in financial markets by facilitating buying and selling, enhancing liquidity, and stabilizing market order. Additionally, algorithms can incorporate varied components such as order flow, market volatility, and liquidity to optimize buying and selling methods. For instance, algorithms might regulate their buying and selling volumes based mostly on the depth of the order guide or execute trades solely when certain price thresholds are met.

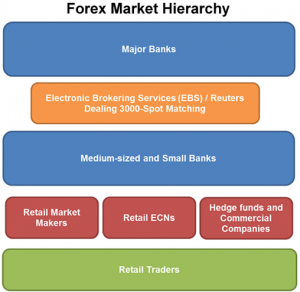

Exchanges just like the NYSE and NASDAQ serve to supply a marketplace where buyers and sellers can meet. Market makers are an important a part of the overall structure of the stock market. The function of market makers is to keep up a level of liquidity, in return for which they cost a bid/ask spread.

How Do Market Makers Work: Faqs

When plenty of trading happens and asset prices change quickly, it’s important to keep the market stable Decentralized finance. They help stop massive value swings by keeping costs steady via their actions. There was a time the place “ax” market makers had the clout to set off self-fulfilling prophecy like indicators. For instance, GSCO absorbing shares on the within bid would trigger merchants to step in front and cause prices to rise. Nonetheless, these days are long gone as the secret is to cover transparency to reduce market influence. Public stock exchanges rely on professional members committed to providing liquidity in particular stocks.

What’s Market Making?

A essential part of their work includes managing portfolio positions to navigate market shifts successfully. Brokers coordinate patrons and sellers by matching buy and sell orders – market makers are there to make positive that trading volume and liquidity are enough by putting lots of large orders. Market makers profit by charging the bid/ask unfold – brokers revenue by charging various fees and commissions. A market maker offers liquidity by buying and selling securities from their own inventory, whereas a dealer acts as an intermediary between consumers and sellers.